Jen Wen Lin

- Courses2

- Reviews14

- School: University of Toronto

- Campus: St. George Campus

- Department: Statistics

- Email address: Join to see

- Phone: Join to see

-

Location:

Toronto, ON - Dates at University of Toronto: October 2015 - May 2019

- Office Hours: Join to see

Biography

University of Toronto St. George Campus - Statistics

Resume

2003

PhD

Dissertation: Essays on Diagnostic Checks in Time Series\nPublications in Journal of Time Series Analysis and Computational Statistics & Data Analysis.

Statistics with scientific computing

The University of Western Ontario

CFA

CFA Institute

2002

Master of Science

Computational Finance

2001

Master of Engineering

Degree project: Calibrating Non-Gaussian HJM Models Using C++

sponsored by J.P. Morgan

ORIE with financial engineering option

Cornell University

asset class

Asset Allocation

Derivatives

strategic asset allocation

Data Analysis

Market Risk

Economics

Asset Management

Risk Management

Time Series Analysis

Statistics

ARIMA

Credit Risk

Quantitative Finance

C++

private asset

CFA

Investment research

strong analytical and quantitative skills

R

Lin

PhD

CFA

Advanced knowledge and professional experience in applying time series analysis and machine learning to dynamic asset allocation

value-based investment strategies as well as modeling private assets

Jen-Wen

Lin

PhD

CFA

CPP Investment Board

University of Toronto

University of Western Ontario

EMA Consult Inc.

AI Squared 平方智能

CIBC

Bank of Montreal

BMO Financial Group

TD Bank Group

Toronto

Canada Area

1.\tBenchmarked and validated quantitative models

including market and (retail and commercial) credit risk\n2.\tSupervised analysts conducting various vetting projects\n3.\tAssisted executives (VP) on ad-hoc research projects

such as measuring liquidity premiums of different risk ratings under stressed economic conditions

Manager

Model Risk and Vetting

Bank of Montreal

London

Honourable academic appointment

Adjunct Professor

University of Western Ontario

Toronto

Canada Area

1. Reported directly to executives (VP/AVP) as a domain expert on quantitative risk modeling as well as conducted requested ad-hoc research projects\n2. Conducted validation on both regulatory and economic capital models for as market risk

credit risk

interest rate risk on banking book and operational risk\n3. Developed economic capital models for insurance business and DB plan\n4. Managed quantitative analysts

Senior Manager

TD Bank Group

Toronto

Canada Area

1. Domain expert in econometrics and private assets' class. \n2. Private asset

such as private equity and commercial real estate\n3. Asset allocation\n4. Design and develop a simulation tool/dashboard for evaluating global macro tilting strategies\n5. Multi-asset class modelling

including credit

equity and real estate\n6. Smart beta strategies and factor modelling\n\n

Senior Associate / TPM

CPP Investment Board

Toronto

1)\tProviding statistical and data science consulting services to companies.\n2)\tClients include BMO Financial Group

and several startup companies.

Principle Consultant

EMA Consult Inc.

Toronto

Canada Area

Conduct innovative research on applied artificial intelligence

digital wealth management

and alternative investments.

Co-Founder

AI Squared 平方智能

1.\tDeveloped segmentation/score card models for residential mortgages\n2.\tDeveloped methodologies to estimate Basel credit risk parameters

such as PD and asset correlation\n3.\tPromoted to Senior Quantitative Analyst in Feburary 2008

CIBC

University of Toronto

Toronto

Canada Area

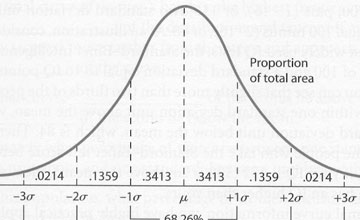

1. Teach time series analysis and supervise graduate research projects\n2. Selective topics taught in the course include\n (1) Autoregressive integrated moving average (ARIMA) model\n (2) Transfer function noise model\n (3) Vector autoregressive model and cointegration (multivariate time series)\n (4) State space model and Kalman filter\n (5) Introduction to bootstrapping time series\n (6) Bagging and Boosting in time series with application to big data\n (7) Time series modelling with Google data\n (8) Application of neural network in time series analysis\n\n3. Topics of past supervised projects include\n (1) Dynamic asset allocation using recurrent reinforcement learning \n (2) Stress testing credit portfolios

including credit cards and residential mortgages\n (3) Pairs trading in stock markets\n (4) Implementing Holt-Winter exponential smoothing models using C#/VBA\n (5) Forecast real estate markets using macro variables\n (6) Time series forecasting with Google data\n

Sessional Lecturer

Time series analysis

Acted as a consultant role helping BMO’s Model Validation Group for urgent and complex projects

including IFRS9/CECL modeling and monitoring framework

Retail AIRB methodology and validation guideline

Economic capital modeling for defaulted accounts

and Gradient boosting model for segmenting US mortgage portfolios.

BMO Financial Group