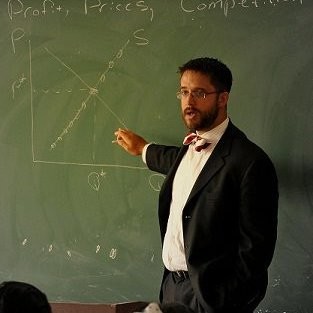

Michael D. Thomas

- Courses6

- Reviews22

- School: Creighton University

- Campus:

- Department: Economics

- Email address: Join to see

- Phone: Join to see

-

Location:

2500 California Plaza

Omaha, NE - 68178 - Dates at Creighton University: September 2014 - July 2019

- Office Hours: Join to see

N/A

Would take again: Yes

For Credit: Yes

2

0

Mandatory

Good

If were you're under the class of Doctor Thomas, be ready to work. He has awesome lectures, but you need to be attentive 100% of the time. He is almost way too smart to be teaching introduction level classes. He definitely cares about his students and will definitely show tough love if he suspects you are not giving your best in the class. You also have to win over his respect, but it pays dividends when you do.

Biography

Creighton University - Economics

Associate Professor at Creighton University

Michael D.

Thomas

Omaha, Nebraska

Michael D. Thomas is a public choice economist who earned a PhD in economics from George Mason university in 2009. He has also studied at Duke University while a fellow at the History of Political Economy Center in 2008-2009. Michael has published papers in Kyklos, the Journal of City and Town Management, the Review of Austrian Economics, and the Journal of Private Enterprise. He is an assistant professor at Creighton University. He has worked at Utah State University, where he was awarded the title, "Distinguished Professor of Honors Education" in 2014. His wife, Diana W. Thomas is an associate professor of economics at Creighton. Michael's interest in monetary economics was stimulated while earning a Masters degree at the University of Missouri--St. Louis and while selling mortgage loans during 2001-2003 as a loan originator. Michael received his bachelors degree from the University of Alabama in 2001 and is an avid college football fan.

Experience

Education

George Mason University

Doctor of Philosophy (PhD)

Economics

University of Alabama

Bachelor of Science (BS) - Commerce and Business Administration

Economics

University of Missouri-Saint Louis

Master of Arts (M.A.)

Economics

Publications

Reapplying behavioral symmetry: public choice and choice architecture

Public Choice

New justifications for government intervention based on behavioral psychology rely on a behavioral asymmetry between expert policymakers and market participants. Public choice theory applied the behavioral symmetry assumption to policy making in order to illustrate how special interests corrupt the suppositions of benevolence on the part of policy makers. Cognitive problems associated with market choices have been used to argue for even more intervention. If behavioral symmetry is applied to the experts and not just to market participants, problems with this approach to public policy formation become clear. Manipulation, cognitive capture, and expert bias are among the problems associated with a behavioral theory of market failure. The application of behavioral symmetry to the expanding role of choice architecture will help to limit the bias in behavioral policy. Since experts are also subject to cognitive failures, policy must include an evaluation of expert error. Like the rent-seeking literature before it, a theory of cognitive capture points out the systematic problems with a theory of asymmetry between policy experts and citizens when it comes to policy making.

Reapplying behavioral symmetry: public choice and choice architecture

Public Choice

New justifications for government intervention based on behavioral psychology rely on a behavioral asymmetry between expert policymakers and market participants. Public choice theory applied the behavioral symmetry assumption to policy making in order to illustrate how special interests corrupt the suppositions of benevolence on the part of policy makers. Cognitive problems associated with market choices have been used to argue for even more intervention. If behavioral symmetry is applied to the experts and not just to market participants, problems with this approach to public policy formation become clear. Manipulation, cognitive capture, and expert bias are among the problems associated with a behavioral theory of market failure. The application of behavioral symmetry to the expanding role of choice architecture will help to limit the bias in behavioral policy. Since experts are also subject to cognitive failures, policy must include an evaluation of expert error. Like the rent-seeking literature before it, a theory of cognitive capture points out the systematic problems with a theory of asymmetry between policy experts and citizens when it comes to policy making.

Entrepreneurship: Catallactic and Constitutional Perspectives

Review of Austrian Economics

The most important distinction between Virginia political economy (VPE) and the other branches of public choice scholarship is a close affinity of the former to Austrian economics. Contributions in both the Virginia and the Vienna (Austrian) traditions have emphasized this connection and highlighted the analytical and ideological interdependencies of the two schools. This paper argues that an application of the Austrian theory of political entrepreneurship to the VPE framework can provide important insights regarding the direction of political change. Kirzner’s theory of entrepreneurship explains that coordination of individual action is possible where price signals provide information. When price signals are absent the entrepreneurial process breaks down. There is common ground between Kirznerian entrepreneurship and Buchanan’s creative action. Scholars at the intersection of the Virginia and the Vienna traditions can use this common ground to make pattern predictions regarding the direction of political change.

Reapplying behavioral symmetry: public choice and choice architecture

Public Choice

New justifications for government intervention based on behavioral psychology rely on a behavioral asymmetry between expert policymakers and market participants. Public choice theory applied the behavioral symmetry assumption to policy making in order to illustrate how special interests corrupt the suppositions of benevolence on the part of policy makers. Cognitive problems associated with market choices have been used to argue for even more intervention. If behavioral symmetry is applied to the experts and not just to market participants, problems with this approach to public policy formation become clear. Manipulation, cognitive capture, and expert bias are among the problems associated with a behavioral theory of market failure. The application of behavioral symmetry to the expanding role of choice architecture will help to limit the bias in behavioral policy. Since experts are also subject to cognitive failures, policy must include an evaluation of expert error. Like the rent-seeking literature before it, a theory of cognitive capture points out the systematic problems with a theory of asymmetry between policy experts and citizens when it comes to policy making.

Entrepreneurship: Catallactic and Constitutional Perspectives

Review of Austrian Economics

The most important distinction between Virginia political economy (VPE) and the other branches of public choice scholarship is a close affinity of the former to Austrian economics. Contributions in both the Virginia and the Vienna (Austrian) traditions have emphasized this connection and highlighted the analytical and ideological interdependencies of the two schools. This paper argues that an application of the Austrian theory of political entrepreneurship to the VPE framework can provide important insights regarding the direction of political change. Kirzner’s theory of entrepreneurship explains that coordination of individual action is possible where price signals provide information. When price signals are absent the entrepreneurial process breaks down. There is common ground between Kirznerian entrepreneurship and Buchanan’s creative action. Scholars at the intersection of the Virginia and the Vienna traditions can use this common ground to make pattern predictions regarding the direction of political change.

"Income-Expenditure Elasticities of Less-Healthy Consumption Goods"

Journal of Entrepreneurship and Public Policy

Purpose To identify how consumption of 12 goods – alcohol, cigarettes, fast food, items sold at vending machines, purchases of food away from home, cookies, cakes, chips, candy, donuts, bacon, and carbonated soft drinks – varies across the income distribution by calculating their income-expenditure elasticites. Design/methodology/approach Data on 22,681 households from 2009-2012 from the Bureau of Labor Statistics’ Consumer Expenditure Survey were used. The data were analyzed using ordinary least squares regressions and Cragg’s double hurdle model which integrates (i) a binary model to determine the decision to consume and (ii) a truncated normal model to estimate the effects for conditional (y > 0) consumption. Findings Income had the greatest effect on expenditures for alcohol (0.314), food away from home (0.295), and fast food (0.284). A one percentage-point increase in income (approximately $428 at the mean) translated into a 0.314 percentage-point increase in spending on alcoholic beverages (approximately $1 annually at the mean). Income had the smallest influence on tobacco expenditures (0.007) and donut expenditures (-0.009). Research limitations/implications Percentage of a household’s discretionary budget spent on the studied goods falls substantially as income gets larger. Policies targeting the consumption of such goods will disproportionately impact lower-income households. Originality/value This is the first manuscript to calculate income-expenditure elasticities for the goods studied. The results allow for a direct analysis of targeted consumption policy on household budgets across the income distribution.

Reapplying behavioral symmetry: public choice and choice architecture

Public Choice

New justifications for government intervention based on behavioral psychology rely on a behavioral asymmetry between expert policymakers and market participants. Public choice theory applied the behavioral symmetry assumption to policy making in order to illustrate how special interests corrupt the suppositions of benevolence on the part of policy makers. Cognitive problems associated with market choices have been used to argue for even more intervention. If behavioral symmetry is applied to the experts and not just to market participants, problems with this approach to public policy formation become clear. Manipulation, cognitive capture, and expert bias are among the problems associated with a behavioral theory of market failure. The application of behavioral symmetry to the expanding role of choice architecture will help to limit the bias in behavioral policy. Since experts are also subject to cognitive failures, policy must include an evaluation of expert error. Like the rent-seeking literature before it, a theory of cognitive capture points out the systematic problems with a theory of asymmetry between policy experts and citizens when it comes to policy making.

Entrepreneurship: Catallactic and Constitutional Perspectives

Review of Austrian Economics

The most important distinction between Virginia political economy (VPE) and the other branches of public choice scholarship is a close affinity of the former to Austrian economics. Contributions in both the Virginia and the Vienna (Austrian) traditions have emphasized this connection and highlighted the analytical and ideological interdependencies of the two schools. This paper argues that an application of the Austrian theory of political entrepreneurship to the VPE framework can provide important insights regarding the direction of political change. Kirzner’s theory of entrepreneurship explains that coordination of individual action is possible where price signals provide information. When price signals are absent the entrepreneurial process breaks down. There is common ground between Kirznerian entrepreneurship and Buchanan’s creative action. Scholars at the intersection of the Virginia and the Vienna traditions can use this common ground to make pattern predictions regarding the direction of political change.

"Income-Expenditure Elasticities of Less-Healthy Consumption Goods"

Journal of Entrepreneurship and Public Policy

Purpose To identify how consumption of 12 goods – alcohol, cigarettes, fast food, items sold at vending machines, purchases of food away from home, cookies, cakes, chips, candy, donuts, bacon, and carbonated soft drinks – varies across the income distribution by calculating their income-expenditure elasticites. Design/methodology/approach Data on 22,681 households from 2009-2012 from the Bureau of Labor Statistics’ Consumer Expenditure Survey were used. The data were analyzed using ordinary least squares regressions and Cragg’s double hurdle model which integrates (i) a binary model to determine the decision to consume and (ii) a truncated normal model to estimate the effects for conditional (y > 0) consumption. Findings Income had the greatest effect on expenditures for alcohol (0.314), food away from home (0.295), and fast food (0.284). A one percentage-point increase in income (approximately $428 at the mean) translated into a 0.314 percentage-point increase in spending on alcoholic beverages (approximately $1 annually at the mean). Income had the smallest influence on tobacco expenditures (0.007) and donut expenditures (-0.009). Research limitations/implications Percentage of a household’s discretionary budget spent on the studied goods falls substantially as income gets larger. Policies targeting the consumption of such goods will disproportionately impact lower-income households. Originality/value This is the first manuscript to calculate income-expenditure elasticities for the goods studied. The results allow for a direct analysis of targeted consumption policy on household budgets across the income distribution.

Sin Taxes and Sindustry: Revenue, Paternalism and Political Interest

The Independent Review

"The new paternalists advocate using excise taxes to discourage “undesirable” behavior and to offset costs imposed on third parties. But using tax policy to socially engineer behavior gives rise to another social pathology: wasteful political entrepreneurship."

Reapplying behavioral symmetry: public choice and choice architecture

Public Choice

New justifications for government intervention based on behavioral psychology rely on a behavioral asymmetry between expert policymakers and market participants. Public choice theory applied the behavioral symmetry assumption to policy making in order to illustrate how special interests corrupt the suppositions of benevolence on the part of policy makers. Cognitive problems associated with market choices have been used to argue for even more intervention. If behavioral symmetry is applied to the experts and not just to market participants, problems with this approach to public policy formation become clear. Manipulation, cognitive capture, and expert bias are among the problems associated with a behavioral theory of market failure. The application of behavioral symmetry to the expanding role of choice architecture will help to limit the bias in behavioral policy. Since experts are also subject to cognitive failures, policy must include an evaluation of expert error. Like the rent-seeking literature before it, a theory of cognitive capture points out the systematic problems with a theory of asymmetry between policy experts and citizens when it comes to policy making.

Entrepreneurship: Catallactic and Constitutional Perspectives

Review of Austrian Economics

The most important distinction between Virginia political economy (VPE) and the other branches of public choice scholarship is a close affinity of the former to Austrian economics. Contributions in both the Virginia and the Vienna (Austrian) traditions have emphasized this connection and highlighted the analytical and ideological interdependencies of the two schools. This paper argues that an application of the Austrian theory of political entrepreneurship to the VPE framework can provide important insights regarding the direction of political change. Kirzner’s theory of entrepreneurship explains that coordination of individual action is possible where price signals provide information. When price signals are absent the entrepreneurial process breaks down. There is common ground between Kirznerian entrepreneurship and Buchanan’s creative action. Scholars at the intersection of the Virginia and the Vienna traditions can use this common ground to make pattern predictions regarding the direction of political change.

"Income-Expenditure Elasticities of Less-Healthy Consumption Goods"

Journal of Entrepreneurship and Public Policy

Purpose To identify how consumption of 12 goods – alcohol, cigarettes, fast food, items sold at vending machines, purchases of food away from home, cookies, cakes, chips, candy, donuts, bacon, and carbonated soft drinks – varies across the income distribution by calculating their income-expenditure elasticites. Design/methodology/approach Data on 22,681 households from 2009-2012 from the Bureau of Labor Statistics’ Consumer Expenditure Survey were used. The data were analyzed using ordinary least squares regressions and Cragg’s double hurdle model which integrates (i) a binary model to determine the decision to consume and (ii) a truncated normal model to estimate the effects for conditional (y > 0) consumption. Findings Income had the greatest effect on expenditures for alcohol (0.314), food away from home (0.295), and fast food (0.284). A one percentage-point increase in income (approximately $428 at the mean) translated into a 0.314 percentage-point increase in spending on alcoholic beverages (approximately $1 annually at the mean). Income had the smallest influence on tobacco expenditures (0.007) and donut expenditures (-0.009). Research limitations/implications Percentage of a household’s discretionary budget spent on the studied goods falls substantially as income gets larger. Policies targeting the consumption of such goods will disproportionately impact lower-income households. Originality/value This is the first manuscript to calculate income-expenditure elasticities for the goods studied. The results allow for a direct analysis of targeted consumption policy on household budgets across the income distribution.

Sin Taxes and Sindustry: Revenue, Paternalism and Political Interest

The Independent Review

"The new paternalists advocate using excise taxes to discourage “undesirable” behavior and to offset costs imposed on third parties. But using tax policy to socially engineer behavior gives rise to another social pathology: wasteful political entrepreneurship."

Institutional Change and the Importance of Understanding Shared Mental Models

Kyklos

Arthur Denzau and Douglass North’s paper “Shared Mental Models: Ideologies and Institutions” seeks to explain differences in economic performance across time and space recognizing that under conditions of uncertainty actors base their decisions “in part upon […] myths, dogmas, ideologies, and ‘half-baked’ theories.” The model Denzau and North develop is firmly rooted in the orthodoxy of economics but emphasizes the significance of shared ideologies and ideas in driving economic change. In this paper, we discuss how the legacy of Denzau and North (1994) should be applied to current and future economic inquiries and, in particular, how it might inform work in development economics, behavioral economics, and in the study of the effects of social norms on economic outcomes. We argue that a perspective that emphasizes the role of the economic actor as entrepreneur in the context of shared mental models and institutions can improve economic analysis in those areas of research, which currently focus on the economist as exogenous policy expert.

Reapplying behavioral symmetry: public choice and choice architecture

Public Choice

New justifications for government intervention based on behavioral psychology rely on a behavioral asymmetry between expert policymakers and market participants. Public choice theory applied the behavioral symmetry assumption to policy making in order to illustrate how special interests corrupt the suppositions of benevolence on the part of policy makers. Cognitive problems associated with market choices have been used to argue for even more intervention. If behavioral symmetry is applied to the experts and not just to market participants, problems with this approach to public policy formation become clear. Manipulation, cognitive capture, and expert bias are among the problems associated with a behavioral theory of market failure. The application of behavioral symmetry to the expanding role of choice architecture will help to limit the bias in behavioral policy. Since experts are also subject to cognitive failures, policy must include an evaluation of expert error. Like the rent-seeking literature before it, a theory of cognitive capture points out the systematic problems with a theory of asymmetry between policy experts and citizens when it comes to policy making.

Entrepreneurship: Catallactic and Constitutional Perspectives

Review of Austrian Economics

The most important distinction between Virginia political economy (VPE) and the other branches of public choice scholarship is a close affinity of the former to Austrian economics. Contributions in both the Virginia and the Vienna (Austrian) traditions have emphasized this connection and highlighted the analytical and ideological interdependencies of the two schools. This paper argues that an application of the Austrian theory of political entrepreneurship to the VPE framework can provide important insights regarding the direction of political change. Kirzner’s theory of entrepreneurship explains that coordination of individual action is possible where price signals provide information. When price signals are absent the entrepreneurial process breaks down. There is common ground between Kirznerian entrepreneurship and Buchanan’s creative action. Scholars at the intersection of the Virginia and the Vienna traditions can use this common ground to make pattern predictions regarding the direction of political change.

"Income-Expenditure Elasticities of Less-Healthy Consumption Goods"

Journal of Entrepreneurship and Public Policy

Purpose To identify how consumption of 12 goods – alcohol, cigarettes, fast food, items sold at vending machines, purchases of food away from home, cookies, cakes, chips, candy, donuts, bacon, and carbonated soft drinks – varies across the income distribution by calculating their income-expenditure elasticites. Design/methodology/approach Data on 22,681 households from 2009-2012 from the Bureau of Labor Statistics’ Consumer Expenditure Survey were used. The data were analyzed using ordinary least squares regressions and Cragg’s double hurdle model which integrates (i) a binary model to determine the decision to consume and (ii) a truncated normal model to estimate the effects for conditional (y > 0) consumption. Findings Income had the greatest effect on expenditures for alcohol (0.314), food away from home (0.295), and fast food (0.284). A one percentage-point increase in income (approximately $428 at the mean) translated into a 0.314 percentage-point increase in spending on alcoholic beverages (approximately $1 annually at the mean). Income had the smallest influence on tobacco expenditures (0.007) and donut expenditures (-0.009). Research limitations/implications Percentage of a household’s discretionary budget spent on the studied goods falls substantially as income gets larger. Policies targeting the consumption of such goods will disproportionately impact lower-income households. Originality/value This is the first manuscript to calculate income-expenditure elasticities for the goods studied. The results allow for a direct analysis of targeted consumption policy on household budgets across the income distribution.

Sin Taxes and Sindustry: Revenue, Paternalism and Political Interest

The Independent Review

"The new paternalists advocate using excise taxes to discourage “undesirable” behavior and to offset costs imposed on third parties. But using tax policy to socially engineer behavior gives rise to another social pathology: wasteful political entrepreneurship."

Institutional Change and the Importance of Understanding Shared Mental Models

Kyklos

Arthur Denzau and Douglass North’s paper “Shared Mental Models: Ideologies and Institutions” seeks to explain differences in economic performance across time and space recognizing that under conditions of uncertainty actors base their decisions “in part upon […] myths, dogmas, ideologies, and ‘half-baked’ theories.” The model Denzau and North develop is firmly rooted in the orthodoxy of economics but emphasizes the significance of shared ideologies and ideas in driving economic change. In this paper, we discuss how the legacy of Denzau and North (1994) should be applied to current and future economic inquiries and, in particular, how it might inform work in development economics, behavioral economics, and in the study of the effects of social norms on economic outcomes. We argue that a perspective that emphasizes the role of the economic actor as entrepreneur in the context of shared mental models and institutions can improve economic analysis in those areas of research, which currently focus on the economist as exogenous policy expert.

The Rise of the Regulatory State Institutional Entrepreneurship and the Decline of Markets for Blood

The Independent Review

The regulatory state, some writers claim, arose in response to failures of the legal system. In the case of blood markets, however, regulation came about not from public outcry caused by faulty laws and courts, but from lobbying by interest groups who expected special benefits from regulation.

Reapplying behavioral symmetry: public choice and choice architecture

Public Choice

New justifications for government intervention based on behavioral psychology rely on a behavioral asymmetry between expert policymakers and market participants. Public choice theory applied the behavioral symmetry assumption to policy making in order to illustrate how special interests corrupt the suppositions of benevolence on the part of policy makers. Cognitive problems associated with market choices have been used to argue for even more intervention. If behavioral symmetry is applied to the experts and not just to market participants, problems with this approach to public policy formation become clear. Manipulation, cognitive capture, and expert bias are among the problems associated with a behavioral theory of market failure. The application of behavioral symmetry to the expanding role of choice architecture will help to limit the bias in behavioral policy. Since experts are also subject to cognitive failures, policy must include an evaluation of expert error. Like the rent-seeking literature before it, a theory of cognitive capture points out the systematic problems with a theory of asymmetry between policy experts and citizens when it comes to policy making.

Entrepreneurship: Catallactic and Constitutional Perspectives

Review of Austrian Economics

The most important distinction between Virginia political economy (VPE) and the other branches of public choice scholarship is a close affinity of the former to Austrian economics. Contributions in both the Virginia and the Vienna (Austrian) traditions have emphasized this connection and highlighted the analytical and ideological interdependencies of the two schools. This paper argues that an application of the Austrian theory of political entrepreneurship to the VPE framework can provide important insights regarding the direction of political change. Kirzner’s theory of entrepreneurship explains that coordination of individual action is possible where price signals provide information. When price signals are absent the entrepreneurial process breaks down. There is common ground between Kirznerian entrepreneurship and Buchanan’s creative action. Scholars at the intersection of the Virginia and the Vienna traditions can use this common ground to make pattern predictions regarding the direction of political change.

"Income-Expenditure Elasticities of Less-Healthy Consumption Goods"

Journal of Entrepreneurship and Public Policy

Purpose To identify how consumption of 12 goods – alcohol, cigarettes, fast food, items sold at vending machines, purchases of food away from home, cookies, cakes, chips, candy, donuts, bacon, and carbonated soft drinks – varies across the income distribution by calculating their income-expenditure elasticites. Design/methodology/approach Data on 22,681 households from 2009-2012 from the Bureau of Labor Statistics’ Consumer Expenditure Survey were used. The data were analyzed using ordinary least squares regressions and Cragg’s double hurdle model which integrates (i) a binary model to determine the decision to consume and (ii) a truncated normal model to estimate the effects for conditional (y > 0) consumption. Findings Income had the greatest effect on expenditures for alcohol (0.314), food away from home (0.295), and fast food (0.284). A one percentage-point increase in income (approximately $428 at the mean) translated into a 0.314 percentage-point increase in spending on alcoholic beverages (approximately $1 annually at the mean). Income had the smallest influence on tobacco expenditures (0.007) and donut expenditures (-0.009). Research limitations/implications Percentage of a household’s discretionary budget spent on the studied goods falls substantially as income gets larger. Policies targeting the consumption of such goods will disproportionately impact lower-income households. Originality/value This is the first manuscript to calculate income-expenditure elasticities for the goods studied. The results allow for a direct analysis of targeted consumption policy on household budgets across the income distribution.

Sin Taxes and Sindustry: Revenue, Paternalism and Political Interest

The Independent Review

"The new paternalists advocate using excise taxes to discourage “undesirable” behavior and to offset costs imposed on third parties. But using tax policy to socially engineer behavior gives rise to another social pathology: wasteful political entrepreneurship."

Institutional Change and the Importance of Understanding Shared Mental Models

Kyklos

Arthur Denzau and Douglass North’s paper “Shared Mental Models: Ideologies and Institutions” seeks to explain differences in economic performance across time and space recognizing that under conditions of uncertainty actors base their decisions “in part upon […] myths, dogmas, ideologies, and ‘half-baked’ theories.” The model Denzau and North develop is firmly rooted in the orthodoxy of economics but emphasizes the significance of shared ideologies and ideas in driving economic change. In this paper, we discuss how the legacy of Denzau and North (1994) should be applied to current and future economic inquiries and, in particular, how it might inform work in development economics, behavioral economics, and in the study of the effects of social norms on economic outcomes. We argue that a perspective that emphasizes the role of the economic actor as entrepreneur in the context of shared mental models and institutions can improve economic analysis in those areas of research, which currently focus on the economist as exogenous policy expert.

The Rise of the Regulatory State Institutional Entrepreneurship and the Decline of Markets for Blood

The Independent Review

The regulatory state, some writers claim, arose in response to failures of the legal system. In the case of blood markets, however, regulation came about not from public outcry caused by faulty laws and courts, but from lobbying by interest groups who expected special benefits from regulation.

Encouraging a Productive Research Agenda: Peter Boettke and the Devil's Test"

Journal of Private Enterprise

Peter Boettke is the single most effective graduate mentor in the Austrian economics tradition today. One of the many teaching tools Boettke uses is the devil’s test. The test is an effective teaching tool because it clarifies what the goals of the political economist as critic can be. Boettke teaches his students that much can be done to clarify the logic of incentives, which in turn clarifies the debate in political advocacy. We argue that the devil’s test is a good example of how Boettke enables students to become not only effective teachers but also productive scholars. The analytical framework of the heuristic enables students to analyze complex policy questions in a rigorous way. Many of Boettke’s students have successfully used the distinction between motivational assumptions and causal processes, which is implicit in the devil’s test, in their research.

Reapplying behavioral symmetry: public choice and choice architecture

Public Choice

New justifications for government intervention based on behavioral psychology rely on a behavioral asymmetry between expert policymakers and market participants. Public choice theory applied the behavioral symmetry assumption to policy making in order to illustrate how special interests corrupt the suppositions of benevolence on the part of policy makers. Cognitive problems associated with market choices have been used to argue for even more intervention. If behavioral symmetry is applied to the experts and not just to market participants, problems with this approach to public policy formation become clear. Manipulation, cognitive capture, and expert bias are among the problems associated with a behavioral theory of market failure. The application of behavioral symmetry to the expanding role of choice architecture will help to limit the bias in behavioral policy. Since experts are also subject to cognitive failures, policy must include an evaluation of expert error. Like the rent-seeking literature before it, a theory of cognitive capture points out the systematic problems with a theory of asymmetry between policy experts and citizens when it comes to policy making.

Entrepreneurship: Catallactic and Constitutional Perspectives

Review of Austrian Economics

The most important distinction between Virginia political economy (VPE) and the other branches of public choice scholarship is a close affinity of the former to Austrian economics. Contributions in both the Virginia and the Vienna (Austrian) traditions have emphasized this connection and highlighted the analytical and ideological interdependencies of the two schools. This paper argues that an application of the Austrian theory of political entrepreneurship to the VPE framework can provide important insights regarding the direction of political change. Kirzner’s theory of entrepreneurship explains that coordination of individual action is possible where price signals provide information. When price signals are absent the entrepreneurial process breaks down. There is common ground between Kirznerian entrepreneurship and Buchanan’s creative action. Scholars at the intersection of the Virginia and the Vienna traditions can use this common ground to make pattern predictions regarding the direction of political change.

"Income-Expenditure Elasticities of Less-Healthy Consumption Goods"

Journal of Entrepreneurship and Public Policy

Purpose To identify how consumption of 12 goods – alcohol, cigarettes, fast food, items sold at vending machines, purchases of food away from home, cookies, cakes, chips, candy, donuts, bacon, and carbonated soft drinks – varies across the income distribution by calculating their income-expenditure elasticites. Design/methodology/approach Data on 22,681 households from 2009-2012 from the Bureau of Labor Statistics’ Consumer Expenditure Survey were used. The data were analyzed using ordinary least squares regressions and Cragg’s double hurdle model which integrates (i) a binary model to determine the decision to consume and (ii) a truncated normal model to estimate the effects for conditional (y > 0) consumption. Findings Income had the greatest effect on expenditures for alcohol (0.314), food away from home (0.295), and fast food (0.284). A one percentage-point increase in income (approximately $428 at the mean) translated into a 0.314 percentage-point increase in spending on alcoholic beverages (approximately $1 annually at the mean). Income had the smallest influence on tobacco expenditures (0.007) and donut expenditures (-0.009). Research limitations/implications Percentage of a household’s discretionary budget spent on the studied goods falls substantially as income gets larger. Policies targeting the consumption of such goods will disproportionately impact lower-income households. Originality/value This is the first manuscript to calculate income-expenditure elasticities for the goods studied. The results allow for a direct analysis of targeted consumption policy on household budgets across the income distribution.

Sin Taxes and Sindustry: Revenue, Paternalism and Political Interest

The Independent Review

"The new paternalists advocate using excise taxes to discourage “undesirable” behavior and to offset costs imposed on third parties. But using tax policy to socially engineer behavior gives rise to another social pathology: wasteful political entrepreneurship."

Institutional Change and the Importance of Understanding Shared Mental Models

Kyklos

Arthur Denzau and Douglass North’s paper “Shared Mental Models: Ideologies and Institutions” seeks to explain differences in economic performance across time and space recognizing that under conditions of uncertainty actors base their decisions “in part upon […] myths, dogmas, ideologies, and ‘half-baked’ theories.” The model Denzau and North develop is firmly rooted in the orthodoxy of economics but emphasizes the significance of shared ideologies and ideas in driving economic change. In this paper, we discuss how the legacy of Denzau and North (1994) should be applied to current and future economic inquiries and, in particular, how it might inform work in development economics, behavioral economics, and in the study of the effects of social norms on economic outcomes. We argue that a perspective that emphasizes the role of the economic actor as entrepreneur in the context of shared mental models and institutions can improve economic analysis in those areas of research, which currently focus on the economist as exogenous policy expert.

The Rise of the Regulatory State Institutional Entrepreneurship and the Decline of Markets for Blood

The Independent Review

The regulatory state, some writers claim, arose in response to failures of the legal system. In the case of blood markets, however, regulation came about not from public outcry caused by faulty laws and courts, but from lobbying by interest groups who expected special benefits from regulation.

Encouraging a Productive Research Agenda: Peter Boettke and the Devil's Test"

Journal of Private Enterprise

Peter Boettke is the single most effective graduate mentor in the Austrian economics tradition today. One of the many teaching tools Boettke uses is the devil’s test. The test is an effective teaching tool because it clarifies what the goals of the political economist as critic can be. Boettke teaches his students that much can be done to clarify the logic of incentives, which in turn clarifies the debate in political advocacy. We argue that the devil’s test is a good example of how Boettke enables students to become not only effective teachers but also productive scholars. The analytical framework of the heuristic enables students to analyze complex policy questions in a rigorous way. Many of Boettke’s students have successfully used the distinction between motivational assumptions and causal processes, which is implicit in the devil’s test, in their research.

Technological Change and the Lowest Common Denominator Problem: An Analysis of Oregon's VMT tax experiment

Journal of Town and City Management

Reapplying behavioral symmetry: public choice and choice architecture

Public Choice

New justifications for government intervention based on behavioral psychology rely on a behavioral asymmetry between expert policymakers and market participants. Public choice theory applied the behavioral symmetry assumption to policy making in order to illustrate how special interests corrupt the suppositions of benevolence on the part of policy makers. Cognitive problems associated with market choices have been used to argue for even more intervention. If behavioral symmetry is applied to the experts and not just to market participants, problems with this approach to public policy formation become clear. Manipulation, cognitive capture, and expert bias are among the problems associated with a behavioral theory of market failure. The application of behavioral symmetry to the expanding role of choice architecture will help to limit the bias in behavioral policy. Since experts are also subject to cognitive failures, policy must include an evaluation of expert error. Like the rent-seeking literature before it, a theory of cognitive capture points out the systematic problems with a theory of asymmetry between policy experts and citizens when it comes to policy making.

Entrepreneurship: Catallactic and Constitutional Perspectives

Review of Austrian Economics

The most important distinction between Virginia political economy (VPE) and the other branches of public choice scholarship is a close affinity of the former to Austrian economics. Contributions in both the Virginia and the Vienna (Austrian) traditions have emphasized this connection and highlighted the analytical and ideological interdependencies of the two schools. This paper argues that an application of the Austrian theory of political entrepreneurship to the VPE framework can provide important insights regarding the direction of political change. Kirzner’s theory of entrepreneurship explains that coordination of individual action is possible where price signals provide information. When price signals are absent the entrepreneurial process breaks down. There is common ground between Kirznerian entrepreneurship and Buchanan’s creative action. Scholars at the intersection of the Virginia and the Vienna traditions can use this common ground to make pattern predictions regarding the direction of political change.

"Income-Expenditure Elasticities of Less-Healthy Consumption Goods"

Journal of Entrepreneurship and Public Policy

Purpose To identify how consumption of 12 goods – alcohol, cigarettes, fast food, items sold at vending machines, purchases of food away from home, cookies, cakes, chips, candy, donuts, bacon, and carbonated soft drinks – varies across the income distribution by calculating their income-expenditure elasticites. Design/methodology/approach Data on 22,681 households from 2009-2012 from the Bureau of Labor Statistics’ Consumer Expenditure Survey were used. The data were analyzed using ordinary least squares regressions and Cragg’s double hurdle model which integrates (i) a binary model to determine the decision to consume and (ii) a truncated normal model to estimate the effects for conditional (y > 0) consumption. Findings Income had the greatest effect on expenditures for alcohol (0.314), food away from home (0.295), and fast food (0.284). A one percentage-point increase in income (approximately $428 at the mean) translated into a 0.314 percentage-point increase in spending on alcoholic beverages (approximately $1 annually at the mean). Income had the smallest influence on tobacco expenditures (0.007) and donut expenditures (-0.009). Research limitations/implications Percentage of a household’s discretionary budget spent on the studied goods falls substantially as income gets larger. Policies targeting the consumption of such goods will disproportionately impact lower-income households. Originality/value This is the first manuscript to calculate income-expenditure elasticities for the goods studied. The results allow for a direct analysis of targeted consumption policy on household budgets across the income distribution.

Sin Taxes and Sindustry: Revenue, Paternalism and Political Interest

The Independent Review

"The new paternalists advocate using excise taxes to discourage “undesirable” behavior and to offset costs imposed on third parties. But using tax policy to socially engineer behavior gives rise to another social pathology: wasteful political entrepreneurship."

Institutional Change and the Importance of Understanding Shared Mental Models

Kyklos

Arthur Denzau and Douglass North’s paper “Shared Mental Models: Ideologies and Institutions” seeks to explain differences in economic performance across time and space recognizing that under conditions of uncertainty actors base their decisions “in part upon […] myths, dogmas, ideologies, and ‘half-baked’ theories.” The model Denzau and North develop is firmly rooted in the orthodoxy of economics but emphasizes the significance of shared ideologies and ideas in driving economic change. In this paper, we discuss how the legacy of Denzau and North (1994) should be applied to current and future economic inquiries and, in particular, how it might inform work in development economics, behavioral economics, and in the study of the effects of social norms on economic outcomes. We argue that a perspective that emphasizes the role of the economic actor as entrepreneur in the context of shared mental models and institutions can improve economic analysis in those areas of research, which currently focus on the economist as exogenous policy expert.

The Rise of the Regulatory State Institutional Entrepreneurship and the Decline of Markets for Blood

The Independent Review

The regulatory state, some writers claim, arose in response to failures of the legal system. In the case of blood markets, however, regulation came about not from public outcry caused by faulty laws and courts, but from lobbying by interest groups who expected special benefits from regulation.

Encouraging a Productive Research Agenda: Peter Boettke and the Devil's Test"

Journal of Private Enterprise

Peter Boettke is the single most effective graduate mentor in the Austrian economics tradition today. One of the many teaching tools Boettke uses is the devil’s test. The test is an effective teaching tool because it clarifies what the goals of the political economist as critic can be. Boettke teaches his students that much can be done to clarify the logic of incentives, which in turn clarifies the debate in political advocacy. We argue that the devil’s test is a good example of how Boettke enables students to become not only effective teachers but also productive scholars. The analytical framework of the heuristic enables students to analyze complex policy questions in a rigorous way. Many of Boettke’s students have successfully used the distinction between motivational assumptions and causal processes, which is implicit in the devil’s test, in their research.

Technological Change and the Lowest Common Denominator Problem: An Analysis of Oregon's VMT tax experiment

Journal of Town and City Management

Rational Irrationality and the Political Process of Repeal: The Women's Organization for National Prohibition Reform and the 21st Amendment

Kyklos

The theory of rational irrationality suggests that voters are biased and do not face sufficient incentives to choose rationally; instead they vote for various private reasons. As a result, socially and economically destructive policies can receive widespread public support. Furthermore, because there is no private benefit of learning from experience, such policies can persist over time. We argue here that despite this otherwise dismal outlook on public policy, the theory of rational irrationality leaves two avenues for economically sensible reform: First, when the ex post costs of irrationality are higher than expected, rationally irrational voters will reduce their consumption of irrationality and demand more rational policies. Second, rationally irrational voters can be convinced to rationally update their policy preferences through the use of appealing rhetoric and persuasion by experts. We discuss these two avenues for reform using the example of the repeal of the 18th amendment, which, as we will show, relied on both updating as well as persuasive campaigning.

Reapplying behavioral symmetry: public choice and choice architecture

Public Choice

New justifications for government intervention based on behavioral psychology rely on a behavioral asymmetry between expert policymakers and market participants. Public choice theory applied the behavioral symmetry assumption to policy making in order to illustrate how special interests corrupt the suppositions of benevolence on the part of policy makers. Cognitive problems associated with market choices have been used to argue for even more intervention. If behavioral symmetry is applied to the experts and not just to market participants, problems with this approach to public policy formation become clear. Manipulation, cognitive capture, and expert bias are among the problems associated with a behavioral theory of market failure. The application of behavioral symmetry to the expanding role of choice architecture will help to limit the bias in behavioral policy. Since experts are also subject to cognitive failures, policy must include an evaluation of expert error. Like the rent-seeking literature before it, a theory of cognitive capture points out the systematic problems with a theory of asymmetry between policy experts and citizens when it comes to policy making.

Entrepreneurship: Catallactic and Constitutional Perspectives

Review of Austrian Economics

The most important distinction between Virginia political economy (VPE) and the other branches of public choice scholarship is a close affinity of the former to Austrian economics. Contributions in both the Virginia and the Vienna (Austrian) traditions have emphasized this connection and highlighted the analytical and ideological interdependencies of the two schools. This paper argues that an application of the Austrian theory of political entrepreneurship to the VPE framework can provide important insights regarding the direction of political change. Kirzner’s theory of entrepreneurship explains that coordination of individual action is possible where price signals provide information. When price signals are absent the entrepreneurial process breaks down. There is common ground between Kirznerian entrepreneurship and Buchanan’s creative action. Scholars at the intersection of the Virginia and the Vienna traditions can use this common ground to make pattern predictions regarding the direction of political change.

"Income-Expenditure Elasticities of Less-Healthy Consumption Goods"

Journal of Entrepreneurship and Public Policy

Purpose To identify how consumption of 12 goods – alcohol, cigarettes, fast food, items sold at vending machines, purchases of food away from home, cookies, cakes, chips, candy, donuts, bacon, and carbonated soft drinks – varies across the income distribution by calculating their income-expenditure elasticites. Design/methodology/approach Data on 22,681 households from 2009-2012 from the Bureau of Labor Statistics’ Consumer Expenditure Survey were used. The data were analyzed using ordinary least squares regressions and Cragg’s double hurdle model which integrates (i) a binary model to determine the decision to consume and (ii) a truncated normal model to estimate the effects for conditional (y > 0) consumption. Findings Income had the greatest effect on expenditures for alcohol (0.314), food away from home (0.295), and fast food (0.284). A one percentage-point increase in income (approximately $428 at the mean) translated into a 0.314 percentage-point increase in spending on alcoholic beverages (approximately $1 annually at the mean). Income had the smallest influence on tobacco expenditures (0.007) and donut expenditures (-0.009). Research limitations/implications Percentage of a household’s discretionary budget spent on the studied goods falls substantially as income gets larger. Policies targeting the consumption of such goods will disproportionately impact lower-income households. Originality/value This is the first manuscript to calculate income-expenditure elasticities for the goods studied. The results allow for a direct analysis of targeted consumption policy on household budgets across the income distribution.

Sin Taxes and Sindustry: Revenue, Paternalism and Political Interest

The Independent Review

"The new paternalists advocate using excise taxes to discourage “undesirable” behavior and to offset costs imposed on third parties. But using tax policy to socially engineer behavior gives rise to another social pathology: wasteful political entrepreneurship."

Institutional Change and the Importance of Understanding Shared Mental Models

Kyklos

Arthur Denzau and Douglass North’s paper “Shared Mental Models: Ideologies and Institutions” seeks to explain differences in economic performance across time and space recognizing that under conditions of uncertainty actors base their decisions “in part upon […] myths, dogmas, ideologies, and ‘half-baked’ theories.” The model Denzau and North develop is firmly rooted in the orthodoxy of economics but emphasizes the significance of shared ideologies and ideas in driving economic change. In this paper, we discuss how the legacy of Denzau and North (1994) should be applied to current and future economic inquiries and, in particular, how it might inform work in development economics, behavioral economics, and in the study of the effects of social norms on economic outcomes. We argue that a perspective that emphasizes the role of the economic actor as entrepreneur in the context of shared mental models and institutions can improve economic analysis in those areas of research, which currently focus on the economist as exogenous policy expert.

The Rise of the Regulatory State Institutional Entrepreneurship and the Decline of Markets for Blood

The Independent Review

The regulatory state, some writers claim, arose in response to failures of the legal system. In the case of blood markets, however, regulation came about not from public outcry caused by faulty laws and courts, but from lobbying by interest groups who expected special benefits from regulation.

Encouraging a Productive Research Agenda: Peter Boettke and the Devil's Test"

Journal of Private Enterprise

Peter Boettke is the single most effective graduate mentor in the Austrian economics tradition today. One of the many teaching tools Boettke uses is the devil’s test. The test is an effective teaching tool because it clarifies what the goals of the political economist as critic can be. Boettke teaches his students that much can be done to clarify the logic of incentives, which in turn clarifies the debate in political advocacy. We argue that the devil’s test is a good example of how Boettke enables students to become not only effective teachers but also productive scholars. The analytical framework of the heuristic enables students to analyze complex policy questions in a rigorous way. Many of Boettke’s students have successfully used the distinction between motivational assumptions and causal processes, which is implicit in the devil’s test, in their research.

Technological Change and the Lowest Common Denominator Problem: An Analysis of Oregon's VMT tax experiment

Journal of Town and City Management

Rational Irrationality and the Political Process of Repeal: The Women's Organization for National Prohibition Reform and the 21st Amendment

Kyklos

The theory of rational irrationality suggests that voters are biased and do not face sufficient incentives to choose rationally; instead they vote for various private reasons. As a result, socially and economically destructive policies can receive widespread public support. Furthermore, because there is no private benefit of learning from experience, such policies can persist over time. We argue here that despite this otherwise dismal outlook on public policy, the theory of rational irrationality leaves two avenues for economically sensible reform: First, when the ex post costs of irrationality are higher than expected, rationally irrational voters will reduce their consumption of irrationality and demand more rational policies. Second, rationally irrational voters can be convinced to rationally update their policy preferences through the use of appealing rhetoric and persuasion by experts. We discuss these two avenues for reform using the example of the repeal of the 18th amendment, which, as we will show, relied on both updating as well as persuasive campaigning.

Governing Nebraska's Fiscal Commons: Addressing the Budgetary Squeeze

Mercatus Center, State and Local Policy

State policymakers involved in drafting state budgets will face increasing difficulties in coming years as the rising cost of spending obligations such as schools, health care, and pension funds strains states’ ability to pay for them. At the same time, federal support for state programs will continue to shrink as the federal government is forced to grapple with its own fiscal problems. States will need to either reform their budgets or raise taxes as a proportion of income. This decision could be game-changing both for state budgets and for federalism more broadly. Economist Michael D. Thomas focuses on trends in the state of Nebraska, which faces a looming fiscal problem. The expansion in the scope of tasks the state now manages, not just in terms of federal programs but also in terms of funding local programs, has resulted in spending mismatches with local priorities and a state government that is squeezed between the federal and local governments. The way forward is to set realistic priorities for spending at the state level. Nebraska has long benefited from a relatively good fiscal position, and is therefore in a better position to manage this task than other states.

Possible Matching Profiles

The following profiles may or may not be the same professor:

- Michael Thomas

Alamance Community College - Psychology - Michael Thomas

Pennsylvania State University - Geography

Possible Matching Profiles

The following profiles may or may not be the same professor:

- Michael Thomas Lum (-10% Match)

Instructional Aide

Glendale Community College - Glendale Community College - Michael Thomas Brooks (-40% Match)

Assistant Dean, Academic Affairs

University Of Arizona - Law Administration - Michael Thomas (00% Match)

Law Enforcement Academy Instructor

Butte-Glenn Community College District - Butte-Glenn Community College District - Michael Thomas Wood (-40% Match)

Lecturer

California State University - California State University - Michael Thomas Burns (-40% Match)

Instructor

Mt. San Jacinto College - Mt. San Jacinto College - Jan-Michael Thomas (20% Match)

Adjunct Associate Professor

San Joaquin Delta College - San Joaquin Delta College - Michael Thomas Mcbride (-10% Match)

Associate Dean

University Of California - University Of California

$162,700.00 Base

$29,777.00 Other

$45,103.00 Benefits - Michael Thomas Mchale (-10% Match)

Clinical Professor

University Of California - University Of California - Michael Thomas Provence (-10% Match)

Professor

University Of California - University Of California - Terence Michael Thomas (-20% Match)

Instructor

Delaware Technical Community College - Stanton Campus - Dtcc/stanton Campus - Robert Michael Thomas (-40% Match)

Faculty

Bainbridge State College - Bainbridge State College - Michael Thomas Gillies (-10% Match)

Assistant Professor

Georgia Military College - Georgia Military College - Michael Thomas Williams (-40% Match)

Adjunct Lecturer

University Of Iowa - University Of Iowa - Michael Thomas Dickinson (10% Match)

Technical College Faculty

Century Community College - Lakewood - Mn St Colleges & Universities - Michael Thomas Tusken (10% Match)

Community College Faculty

Fond du Lac Tribal & Community College - Mn St Colleges & Universities - Michael Thomas Pallante (-10% Match)

Continuing Education Teacher

College of Staten Island - College Of Staten Island Adj - Michael Thomas (00% Match)

Associate Professor

Hunter College - Hunter College - Michael Thomas Rowan JR (30% Match)

Adjunct Assistant Professor

John Jay College of Criminal Justice - John Jay College Adj - Michael Thomas Rowan JR (30% Match)

Assistant Professor

John Jay College of Criminal Justice - John Jay College - Michael Thomas Mitchell (-40% Match)

Adjunct Assistant Professor

New York City College of Technology - Nyc College Of Technology Adj - Michael Thomas Fama (-10% Match)

Instructor

Stony Brook University - [email protected] - Michael Thomas Mcgrory (-10% Match)

Adjunct Lecturer

SUNY Maritime College - State University Maritime Coll